4 Ways myTrack Delivers Value for the IRA Tax Credit

The Inflation Reduction Act (IRA) provides $500 billion in new spending and tax breaks to boost clean energy, increase tax revenues, and reduce healthcare costs. Under IRA section 48c(e), companies may be able to qualify for an investment tax credit of up to 30% of qualified green projects.

Management Controls’ myTrack Platform, which automates time tracking and can show the percentage of apprentices companies have on hand, can help companies confirm they meet initial prevailing time and apprenticeship requirements to qualify for the 48C(e) tax credit.

Let’s dig into four value levers in myTrack that could help your business qualify for your next tax credit. In fact, this 30% credit would be more than enough to offset your investment in myTrack and consulting services.

1. How does myTrack identify projects that qualify for the Inflation Reduction Act (IRA) credits?

myTrack streamlines the process to help you identify projects eligible for the Inflation Reduction Act (IRA) credits. It offers a high-level view so you can pinpoint specific projects that qualify. This is crucial, as the IRA has precise requirements for eligibility, such as projects that reduce emissions, capture carbon, or involve green and renewable technologies.

With myTrack, you can effortlessly tag and track all associated costs, including labor, equipment, and materials, against a specific job. This feature is useful in scenarios where you must verify if a job at a given site qualifies for IRA projects. For instance, if a clean industry widget is installed, myTrack enables you to collate all related work and costs, ensuring that every aspect of the project is identifiable and accounted for.

The platform's ability to label and organize costs is a game-changer. Whether you have multiple contractors working on a project or various purchase orders, myTrack simplifies the process. You can search by project name, like 'Project Tiger,’ and tag everything accordingly. This ensures that all related costs are easily accessible and compiled, making it straightforward to determine your eligibility for IRA credits.

In essence, myTrack is a valuable tool for companies who want to identify which jobs qualify for the IRA credit. Its user-friendly interface and detailed tracking capabilities make it an indispensable asset for staying compliant and maximizing potential tax credits.

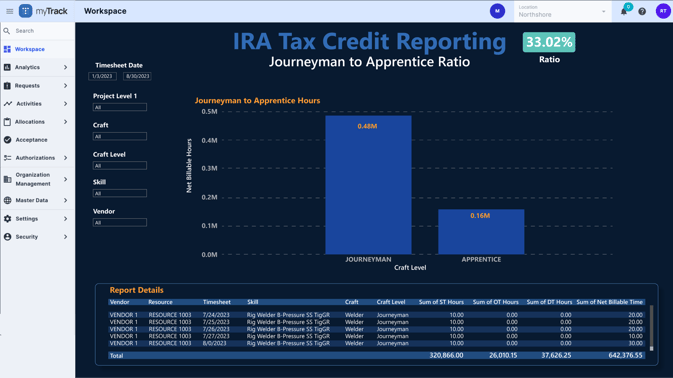

2. How does myTrack help you meet the apprenticeship requirements?

Understanding the IRA's focus on apprenticeships is crucial. It's not just about tracking costs and hours, but also about maintaining specific ratios of apprentices to skilled workers.

myTrack excels in providing detailed insights into your workforce. It can display all your crafts, breaking down the hours and costs by individual and by day. Think of it as navigating a staircase. First, you pull out projects by label, including all purchase orders and vendors, to view the labor costs. The next step involves understanding the number of apprenticeships and breaking down the total labor cost by craft, associated with each individual worker. This leads to identifying the number of hours spent and the expenditure on each.

Our dashboards are designed to clearly show the ratio of apprenticeship hours by job. This is crucial because compliance isn't just about the total number of craftspeople; it's about maintaining the correct ratio. For instance, if you have 1,000 workers, you need to ensure that 10% are apprentices, and this ratio needs to be drilled down into specific details.

myTrack simplifies this process. Without it, companies would have to manually compile billing rates, add up hours, and calculate ratios – a time-consuming and error-prone process. With myTrack, you get real-time insights, allowing you to adjust your workforce as needed to meet the apprenticeship ratios.

Additionally, myTrack can help track the cumulative apprenticeship ratio over the lifecycle of a project. For example, if your payroll on Monday shows work on a qualifying job at the prevailing wage, and the apprenticeship rate is 15%, myTrack can track and adjust this ratio in real time. This ensures eligibility for the credit, providing a comprehensive view of your apprenticeship ratio as it evolves.

In summary, myTrack identifies eligible projects and provides the necessary tools to ensure compliance with the IRA's apprenticeship requirements, offering real-time insights and detailed workforce tracking to maintain the required ratios.

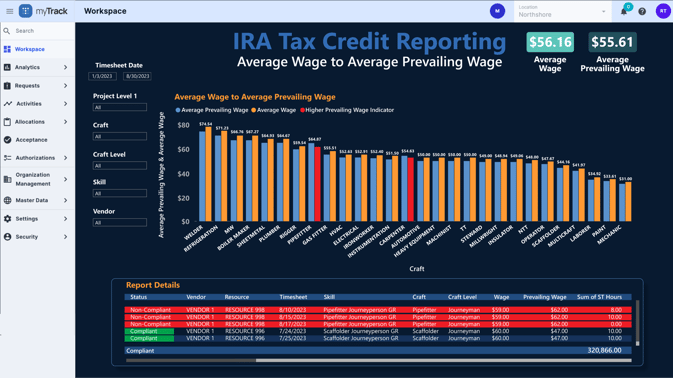

3. How does myTrack address the prevailing wage requirement?

myTrack plays a crucial role in ensuring compliance. The prevailing wage is the rate paid to the employee, which is a critical factor in qualifying for IRA credits. myTrack allows contractors to input their comprehensive bill rate, which can be compared against the prevailing wage.

For example, our Insights team could input the prevailing wage for each county and import the contractor's data to ensure there is no variance. It's important to note that paying more than the prevailing wage is permissible. myTrack can provide a prevailing wage dashboard or KPI tracker that pulls in daily data on wages and the personnel who worked on eligible projects. This helps to ensure you're meeting the prevailing wage requirements and helps avoid any discrepancies that could disqualify you from receiving the credit.

We can provide a dashboard that would display both the bill rate and the payroll records, enabling users to build a table that finds and compares the prevailing wage.

4. How does myTrack assist with the material credit for Made in America?

This requirement stipulates that all manufacturing processes for iron and steel products, which are structural, must occur in the United States. This excludes metallurgical processes involving the refinement of steel additives.

For certain materials, particularly those that are not predominantly manufactured in the U.S. like solar panels, it's crucial to provide proof if they were made in the U.S., like solar panels, it's crucial to provide proof that can play a vital role here by keeping and uploading material receipts to demonstrate that products are made in the U.S.

In the material module of myTrack, users can attach documentation proving that materials were purchased in the U.S. This feature ensures that records are kept indefinitely, providing the necessary documentation to prove compliance with this requirement. While submitting these records might not always be mandatory, having them readily available in myTrack is a significant value lever.

The ability to record and retain this information indefinitely within myTrack not only aids in immediate compliance but also serves as a long-term resource for audit and verification purposes. This ensures that businesses can confidently meet the IRA requirements and potentially benefit from additional tax credits related to the use of American-made materials.

Take the Next Step with myTrack

With myTrack, you can unlock a potential 30% IRA tax credit for your organization by meeting prevailing wage and registered apprenticeship requirements. myTrack is your gateway to ensuring compliance and capitalizing on substantial tax incentives.

Existing customers should reach out to their customer account manager to request a customized dashboard to track information relevant to the 48C(e) incentive. Those new to Management Controls should contact sales@mccorp.com to find out how we can help you qualify for the tax credits.